Secure Your Best Mortgage & Protection, Personalised to You.

5-Star Rated, Mortgage and Family Protection Advice, Crafted To Fit Your Unique Needs And Circumstances. Exploring Every Option To Find The Best Fit For You.

Expert Mortgage Advice Without the Sales Pitch.

Buying your first home, moving up (or around) the property ladder, or even securing the right buy-to-let deal shouldn’t be overwhelming.

At Laura Lewis Financial, we provide expert mortgage and protection advice, for you and your family, throughout Northern Ireland and the UK.

All without any sales pitch whatsoever.

Our complete mortgage guidance service gives you clarity on your borrowing power, strengthens your application, and helps you secure the best deal for your unique needs.

How We can help you...

Expert mortgage and protection advice. We work from a comprehensive panel, representative of the whole of the UK market, to help find the right deal for your individual needs.

5-star rated service that’s friendly, professional, and clear.

Over 20 years of experience helping clients across Northern Ireland.

Personal, one-on-one guidance, bespoke to your unique situation.

Support at every stage, from finding the right deal to submitting the application and beyond.

Whether you’re buying your first home, moving to a new place, or looking to protect your family, Laura and the team are here to make the process simple and stress-free.

As a specialist helping people just like you across Northern Ireland, you’ll get clear, expert advice and the confidence of knowing you’d have secured the best mortgage and protection that's possible for you and for your future...

For Our Complaints Process: Click Here

Laura Lewis

CeMap | CeRER | Experienced Mortgage Advisor

Laura Lewis: Leading a Team Dedicated to Finding the Right Mortgage & Protection for You

With over 20 years’ experience helping people across Northern Ireland & the UK herself — Laura Lewis leads a friendly, expert team that makes securing the right mortgage and protection clear, stress-free, and personalised entirely to you and your needs.

No jargon, no pressure. Just advice you can trust.

Why Book a Call with Laura and Her Team?

You’ll get a friendly expert who listens, understands, and gives you clear, step-by-step advice so you can make confident decisions about your mortgage and protection.

Led by Laura Lewis, our team searches a comprehensive panel representative of the whole UK market to find the most suitable deals for you.

Then we guide you through every stage — so you can enjoy the excitement of your new home, or relax knowing your remortgage is in expert hands — while we handle all the paperwork.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Unlock the Possibilities: Personalised Solutions for Your Unique Needs

At Laura Lewis Financial, we’re here to help you achieve your goals, no matter your mortgage needs.

We search the entire market for lenders, not just the banks and high street options. That means the ideal mortgage for you and your unique circumstances could be out there, waiting to be discovered.

Something you might not find on your own.

First-time Buyers

Get expert guidance and step-by-step support to secure your first home with confidence.

From assessing your borrowing power to handling all the paperwork, we make the process smooth and stress-free, giving you the clarity and peace of mind you deserve...

Home Movers

Upsizing, downsizing, or relocating? We’ve got you covered with expert guidance at every step.

We’ll help you secure the best mortgage deals, handle the complexities of the move, and keep things as stress-free as possible.

Remortgage

Save money or unlock extra funds with tailored remortgage options, empowering you to make the most of your financial situation, whether it’s reducing payments or freeing up funds for life’s next chapter.

Buy-to-Let

Discover competitive deals and personalised advice for your investment property, no matter where you are in your journey.

Family protection

Protect What Matters Most – You and Your Family.

Secure you and your family’s future with personalised protection plans.

Whether it’s life insurance, critical illness cover, or income protection, we’ll help you find the right solution to safeguard you and your loved ones...

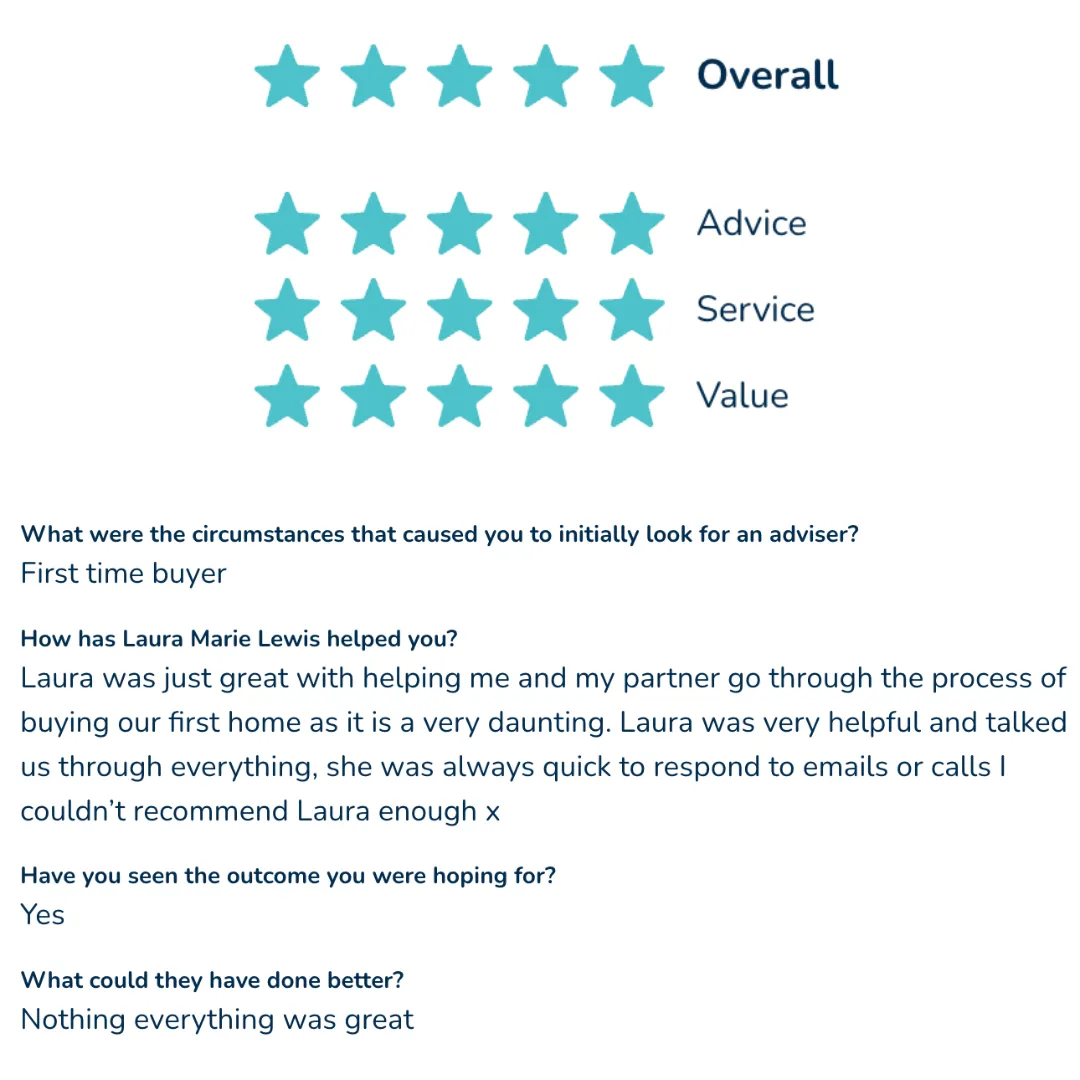

See What Our Customers Say About Us...

Kind words from our clients.

300+ five-star reviews across Google and VouchedFor. Here are just a few...

Frequently Asked Questions

Find answers to common enquiries about our financial advisory services.

What services do you offer?

We offer mortgage and protection advice for first-time buyers, home movers, remortgages, and buy-to-let. Our services include tailored mortgage sourcing, application support, and ongoing guidance throughout the process.

How does the mortgage process work?

We’ll start by understanding your unique situation and goals, then research the best mortgage deals across the market. We’ll guide you through every step, from the initial application to final approval and beyond.

How long does it take to secure a mortgage?

The process can vary, but typically it takes around 4–6 weeks from application to mortgage offer, depending on your circumstances and the lender’s process.

Do you offer protection advice as well?

Absolutely! We can help you find suitable protection for your home, family, and income — such as life insurance, critical illness cover, and income protection — to give you peace of mind.

Is the consultation call really complimentary?

Yes, the initial consultation is completely complimentary. It’s an opportunity for us to get to know each other and for us to understand your needs — no obligation to move forward. No cost.

Can you help if I’m self-employed or have poor credit?

Yes! Laura has experience helping self-employed clients and those with less-than-perfect credit histories. So, we’ll explore all available options to find a suitable deal for you.

Why work with a mortgage advisor who can search a broad range of lenders and products?

Because it gives you more choice and a better fit for your individual needs. Plus it'll likely be a lot less stressful over the course of your mortgage.

By working with a mortgage advisor who can search a comprehensive panel representative of the whole market of lenders, you’re not limited to just one bank or a small selection of products.

Instead, you get access to a broad range of lenders and deals — including ones you might not find on the high street.

We compare the options, explain them in plain English, and recommend what’s most suitable for your needs and circumstances.

That way, you can be confident you’re making the right decision, while we handle the legwork and the paperwork.

How do I get started?

It’s simple — just book a free consultation with us. We’ll talk about your needs, and explain how we can help you achieve your mortgage and protection goals. Even if you're not ready to move forward yet.

A fee may be charged for mortgage advice, depending on your circumstances. Typically, this will range from £0 to £495, with the average fee being £195. The exact amount will depend on the complexity of the mortgage application and will be discussed and agreed with you at the earliest opportunity.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Laura Lewis Financial Ltd is an Appointed Representative of PRIMIS Mortgage Network, a trading name of First Complete Limited. First Complete Limited is authorised and regulated by the Financial Conduct Authority

Most Buy-to-Let mortgages are not regulated by the Financial Conduct Authority

The guidance and/or information contained within the website is subject to UK regulatory regime and is therefore targeted at consumers based in the UK.

Registered Office Address:

Opus House, 137 York Road, Belfast, Northern Ireland, BT15 3GZ.

Registered in Northern Ireland. Company Registration Number: NI709006.

Trading Address:

Suite 125, The Kelvin, 17-25 College Square East, Belfast BT1 6DH

© Copyright 2025 Laura Lewis Financial Ltd. All rights reserved. Reproduction or duplication of this website or contents is strictly prohibited.